Finance transformation

We ignites efficient processes, optimal tools, and strategic insights adapted to each country helping transforming your financial settings

Objectives

Optimizing business profitability through the transformation of the finance function

High-performing

finance

functions

Liberate staff

from operational and routine tasks

Sustain an optimized control

environment

Key transformation areas

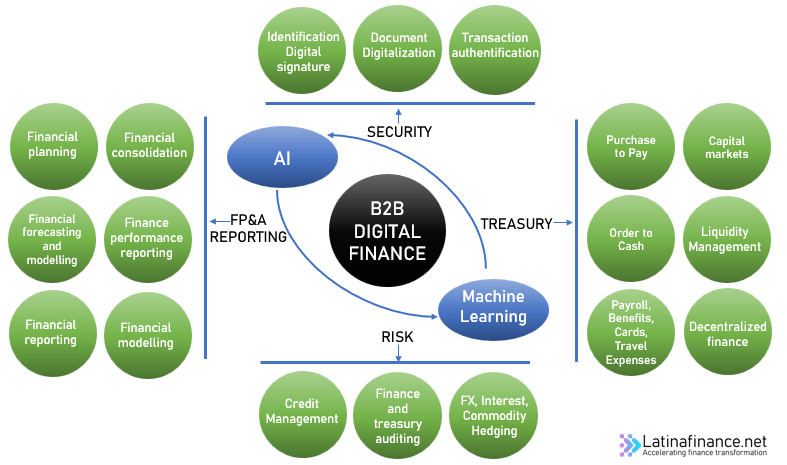

Transformation areas include, treasury, risk, FP&A reporting as well as security

Best practices

An effective finance transformation roadmap is tailored to the unique needs and goals of your organization. It should be flexible enough to accommodate changes in business priorities and external factors while keeping the end objectives in focus.

Assess Current State

Begin by evaluating your current finance function, including its processes, systems, and organizational structure. Identify strengths, weaknesses, and areas for improvement.

Define Vision and Objectives

Clearly articulate the desired future state of your finance function.

Identify the goals, outcomes, and objectives you aim to achieve through the transformation.

Align with Business Strategy

Ensure that the finance transformation roadmap aligns with your organization’s overall strategic goals and priorities. Identify how the finance function can contribute to the broader business objectives.

Engage Stakeholders

Involve key stakeholders, such as finance leaders, executives, and department heads, in the transformation planning process. Seek their input, address concerns, and secure buy-in for the roadmap.

Identify Priorities

Determine the areas of finance transformation that are most critical and impactful for your organization. Prioritize initiatives based on their potential to drive value and align with the defined objectives.

Develop Action Plans

Break down the transformation initiatives into actionable projects or workstreams.

Define the scope, timelines, resource requirements, and key milestones for each project.

Consider Change

Management

Recognize that finance transformation involves organizational change. Develop a change management strategy that addresses communication, training, and support to ensure smooth adoption and acceptance of the changes.

Monitor and

Measure Progress

Establish metrics and key performance indicators (KPIs) to track the progress and success of each initiative.

Regularly review and report on the progress, making adjustments as needed.

Continuously

Improve

Embrace a culture of continuous improvement throughout the finance transformation journey.

Solicit feedback, evaluate results, and refine the roadmap and initiatives as you learn and evolve.

Step by step approach

From roadmap definition to implementation

Priorization

Evaluate and prioritize opportunities and set a transformation roadmap.

Assessing different possibilities or options and determining their relative importance or value. We will analyse various opportunities, considering their potential benefits, risks, and feasibility, and then rank or organize them based on their significance or potential impact.

Optimization

Develop a future-oriented blueprint with best practices, case studies and tools.

Defining the specific tasks, deliverables, and objectives of our work engagement while incorporating the most effective and efficient practices that are relevant and commonly used within the local context.

Implementation

Ensure project adhere to established timelines, budgets, and maintain long-term viability.

We stick to established timelines, budgets, and long-term viability so we can can enhance project success and minimize risks. It helps maintain project momentum, financial control, and ensures that the transformation efforts align with your strategic objectives while delivering sustained value over time.