A very singular way of paying distributable profit

Once distributable income has been calculated the company has the option to either pay dividends or interest on shareholders’ equity or a combination of both. Let’s take a better look at interest on shareholders’ equity or JCP (Juros sobre Capital Próprio), a very singular way of paying distributable profit.

Starting from January 1, 1996, Brazilian corporations have had the authorization to make interest payments to shareholders and consider these payments as a deductible expense when calculating Brazilian income tax and, since 1997, the social contribution tax.

The annual tax deduction is capped at the higher of (i) 50 % of its net income (after deducting the provision for social contribution on net profits but before accounting for the provision for income tax and interest on shareholders’ equity) for the relevant period, and (ii) 50 % of retained earnings.

The interest rate applied in the computation of interest on shareholders’ equity cannot surpass the prorated daily variation in the Long-Term Interest Rate index (Taxa de Juros de Longo Prazo). Net interest payments on shareholders’ equity, after withholding income tax, may be considered as part of the mandatory dividend distribution. According to applicable laws, the company is obligated to remit to its shareholders an amount ensuring that the net sum they receive for interest on shareholders’ equity, after the payment of any applicable withholding tax plus the distributed dividends, is at least equivalent to the mandatory dividend amount.

It can form part of the mandatory shareholder payment

The concept of Interest Attributable to Shareholders’ Equity provides an alternative avenue to traditional dividend payments and forms an integral part of the calculation process for mandatory shareholder disbursements, by corporate legislation. Brazilian Corporate Law mandates that companies incorporate into their bylaws a minimum percentage of available profits for annual dividend distribution, known as the mandatory dividend. This required payment must be disbursed to shareholders in either dividends or interest on shareholders’ equity, in compliance with Law No. 9,249/95.

By its bylaws and Brazilian Corporate Law, the company is obliged to reserve a minimum of 25% of its adjusted net income for the distribution of the mandatory dividend to shareholders. The allocation of mandatory dividends may be limited to the realized net income for the year, with any excess being recorded as an unrealized profit reserve. The determination of net income, allocation to reserves, and distributable amounts are guided by annual financial statements prepared in adherence to Brazilian Corporate Law.

The declaration of annual dividends necessitates approval at the shareholders’ meeting and is contingent upon various factors including operational outcomes, financial status, cash needs, prospects, and other pertinent considerations as determined by shareholders and the Board of Directors. Despite the company’s obligation to distribute mandatory dividends annually under Brazilian Corporate Law, the board of directors retains the authority to suspend such distribution if deemed imprudent given the company’s financial standing. Any suspension would be subject to review by the fiscal council, if in place, with management required to submit a report to the CVM detailing the rationale behind the suspension. Undistributed net income resulting from a suspension would be earmarked for a separate reserve and distributed as dividends when the company’s financial situation allows.

Under Brazilian Corporate Law, participants at a publicly traded company’s shareholders’ meeting can decide, with no opposition from present shareholders, to pay dividends in a lesser amount than the mandatory dividend or withhold the total net income to raise funds through maturing and non-convertible debentures.

Dividends paid as interest on shareholders’ equity are considered deductible expenses for Corporate Income Tax (Imposto de Renda Pessoa Jurídica), or IRPJ, and the Social Contribution on Net Income (Contribuição Social Sobre o Lucro Líquido), or CSLL.

Regulation, beneficiaries, and payment rules

As per Brazilian Corporate Law and the company’s bylaws, it is mandated to convene an annual shareholders’ meeting no later than four months after the conclusion of the fiscal year. During this meeting, shareholders deliberate on various matters, including voting on the allocation of the fiscal year’s results and the distribution of an annual dividend. The disbursement of annual dividends is contingent upon the examination of audited financial statements prepared for the immediately preceding year.

Every holder of common shares at the time a dividend is declared possesses the entitlement to receive dividends. By Brazilian Corporate Law, dividends are generally expected to be disbursed within 60 days from the date of declaration, unless an alternative payment date is established through a shareholders’ resolution. Any such alternative payment date must fall before the conclusion of the year in which the dividend is declared. Shareholders retain a three-year window, starting from the date of dividend payment, to claim dividends or interest on shareholders’ equity of their shares. After this period, any unclaimed dividend amount legally reverts to the shareholders.

As outlined in the company’s bylaws, the board of directors holds the authority to declare interim dividends or pay interest on shareholders’ equity, based on profits or profit reserves disclosed in semi-annual financial statements. Furthermore, the board of directors may request the preparation of balance sheets for periods shorter than six months, allowing for the declaration of interim dividends or the distribution of interest on shareholders’ equity based on the profits or profit reserves indicated in these balance sheets. It is important to note that the total dividends paid in each six months should not surpass the aggregate amount of the company’s capital reserves.

According to the bylaws, the board of directors has the discretion to declare interim dividends or pay interest on shareholders’ equity utilizing accumulated profits or profit reserves reported in the annual or semi-annual financial statements. Payments of interim dividends or interest on shareholders’ equity can be offset against the mandatory dividend amount related to the net income of the year in which the interim dividends were disbursed.

New restrictions since 2023

This means of distribution of net profit was qualified in 2023 as “enriching the rich” by Lula’s appointed economic minister Fernando Haddad. He proposed a resolution to Congress to abolish the JCP. In the end, the government was unable to put an end to the mechanism that makes large companies pay less tax, but they managed to include some restrictions. The planned changes (will be a form of indirect tax increase, from the IRPJ (Corporate Income Tax) and CSLL (Social Contribution on Net Profit). Instead of doing away with JCP, the House of Representatives approved a text that establishes criteria and restricts the amounts that companies can consider when calculating JCP. In other words, how this company expense will be deducted from the basis for calculating federal taxes will be more restricted. The final text approved by the senate is far lighter than what was preconized by the government. Maybe because they realized that abolishing or reducing the JCP would automatically cancel the income for the government of the 15% withholding tax.

Restricting the asset perimeter

The company will not be able to consider gains in equity resulting from corporate acts between dependent parties, “which do not involve an effective inflow of assets to the legal entity, with a definitive increase in equity”. This should stop companies from artificially increasing the basis for paying JCP by including some subordinate venture that does not represent an effective increase in the value of the company’s assets.

Up until today a lot of companies were artificially extending the perimeter so they could pay less IRPJ (Income tax) and CSLL (Social contribution tax) – even if there was no increase in equity. The rule prohibits this possibility from 1 January 2024, following senate approval on December 20th, 2023.

Confirmation of sources eligible for interest on shareholder’s equity payment

On December 20th the Senate also confirmed that the following sources of funds can be used for the payment of interest on capital:

- Paid-in share capital.

- Capital reserves.

- Profit reserves – except for the tax incentive reserve resulting from government donations or subsidies for investments.

- Treasury shares

- Accumulated profits or losses

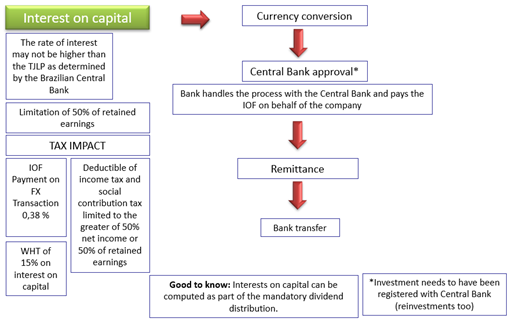

Tax impact and foreign remittance process

Contrary to dividends which are nontaxable in Brazil, interest on shareholders’ equity is subject to a 15% withholding tax.

Once the company has determined the amount of JCP it wants to pay it will request the bank to proceed to the transfer offshore. Once the bank obtains approval from the Central Bank it will initiate the transfer. The bank will pay on the company’s behalf the IOF of 0,38% on foreign transactions (up until 2029 this IOF is payable).