Offshore loans: best practices and focus on Argentina, Brazil, Chile, Colombia and Mexico

After carefully reviewing your capital structure and studying other forms of funding such as equity injection or local financing, you have finally decided that you would fund your local entity using an offshore loan. There are several challenges which require careful planning, expertise, and a thorough understanding of the legal and regulatory framework governing offshore lending in Latin American countries.

Generally, there are two types of offshore funding, and their tax treatment can differ depending on the country. First intercompany funding from a group mother or sister company based in another country and, secondly an offshore loan from a financial institution. Before looking at each specific country’s regulation, let’s maybe summarise some key issues that you need to have in mind.

Tax regulations, legal compliance, and documentation requirements:

Latin American countries often have complex tax regulations governing offshore transactions. These regulations may include withholding tax requirements on interest payments made to foreign lenders. Ensuring compliance with local and international tax laws can be complex and time-consuming. Understanding the specific requirements of each country and navigating potential legal hurdles is crucial. This applies for example to minimum debt-to-capital ratios but also encompasses transfer pricing rules. Interests and FX loss deductibility are also important issues to consider. Meeting the documentation requirements set forth by tax authorities can be cumbersome. Properly documenting the nature of the lending transactions and establishing eligibility for any tax exemptions or reduced rates is essential..

Tax planning including double tax treaties:

Developing effective tax planning strategies tailored to the specific circumstances of the lending transactions and the applicable tax laws is critical. This may involve structuring the transactions tax-efficiently and considering the use of intermediate holding companies or other legal entities. Some countries may have double taxation treaties in place with offshore jurisdictions. Understanding the provisions of these treaties and utilizing them effectively to minimize withholding tax liabilities is very important. Some multinationals for example fund some of their subsidiaries from their structure in Japan to minimize WHT impact.

Resource allocation and cross-border coordination:

Overcoming withholding tax challenges requires dedicating significant resources, including financial, legal, and tax expertise. Allocating these resources effectively to address the complexities involved can be a challenge. Coordinating with various stakeholders, including lenders, borrowers, legal advisors, and tax authorities across different jurisdictions, adds another layer of complexity especifically in Latam where each country has to be adressed separately.

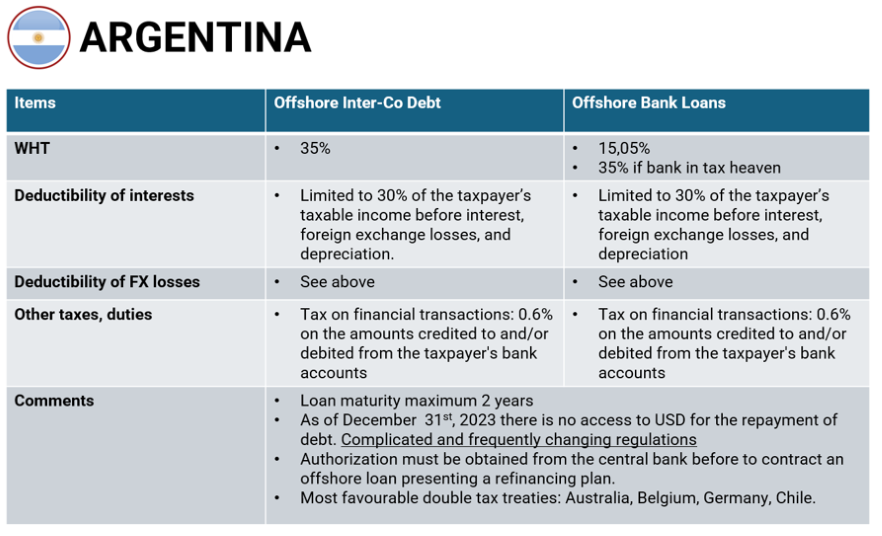

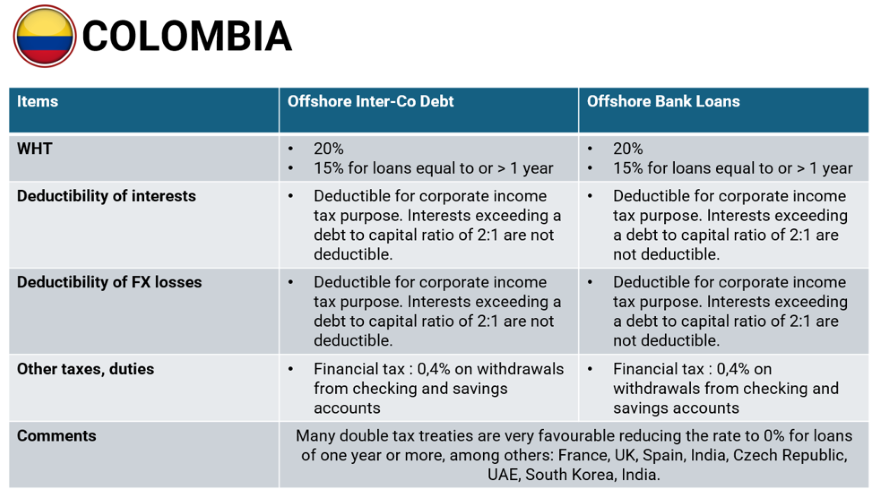

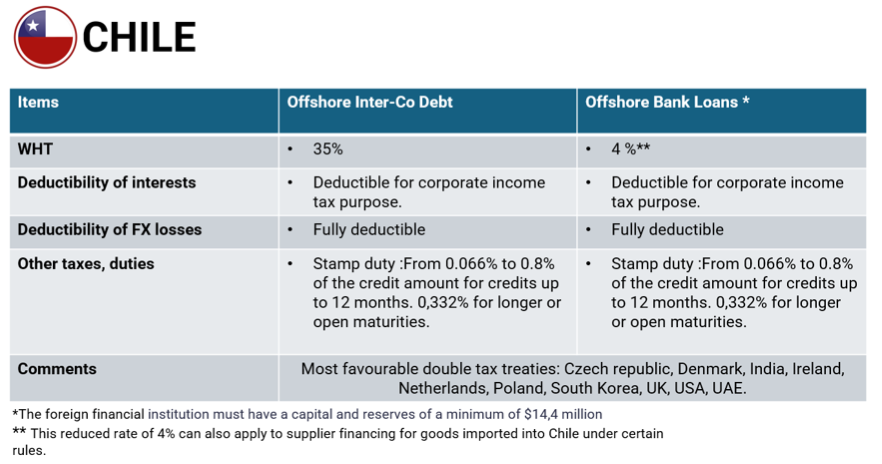

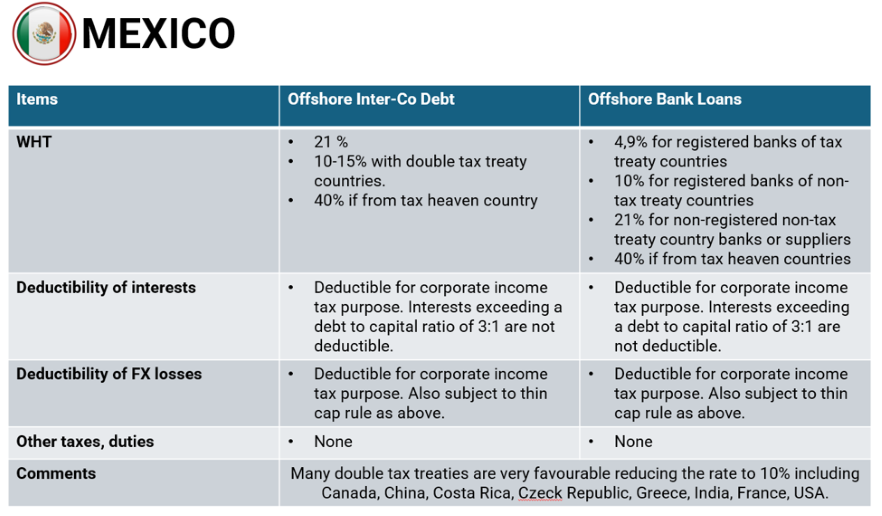

The magic tables on offshore loan WHT and favourable tax treaties

Note : “Please note that while we strive to provide accurate and up-to-date information, we are not qualified tax advisers, and the content provided here should not be construed as professional tax advice. Tax laws and regulations are subject to change, and individual circumstances may vary. Therefore, it is recommended to consult with a certified tax professional or accountant for personalized guidance tailored to your specific situation. We do not accept any responsibility for the consequences of actions taken based on the information provided.”