Regulation, beneficiaries, and payment rules

As per Brazilian Corporate Law and the company’s bylaws, the company must convene an annual shareholders’ meeting no later than four months after the close of the fiscal year. During this meeting, among other agenda items, shareholders exercise their voting rights to determine the allocation of the fiscal year’s results and the distribution of an annual dividend.

The disbursement of annual dividends is contingent upon the audited financial statements prepared for the immediately preceding year.Any holder of common shares at the time a dividend is declared is eligible to receive dividends.

Per Brazilian Corporate Law, dividends are generally required to be disbursed within 60 days from the declaration date, unless an alternative payment date is established through a shareholders’ resolution. Such an alternative date must fall before the conclusion of the year in which the dividend is declared.

Shareholders maintain a three-year window from the dividend payment date to claim their entitled dividends. After this period, any unclaimed dividend amount legally reverts to the company.The bylaws grant authority to the board of directors to declare interim dividends based on profits or profit reserves reported in semi-annual financial statements. Additionally, the board may request the formulation of balance sheets for periods shorter than six months, declaring interim dividends or disbursing interest on shareholders’ equity, utilizing profits or profit reserves from these balance sheets. It is important to note that the total dividends distributed in each six months should not exceed the aggregate amount of capital reserves.

According to the bylaws, the board of directors has the prerogative to declare interim dividends based on accumulated profits or profit reserves reported in the annual or semi-annual financial statements. Payments of interim dividends may be set off against the mandatory dividend amount on the net income of the year in which the interim dividends were disbursed.

Yes, Brazil has established a mandatory shareholder payment

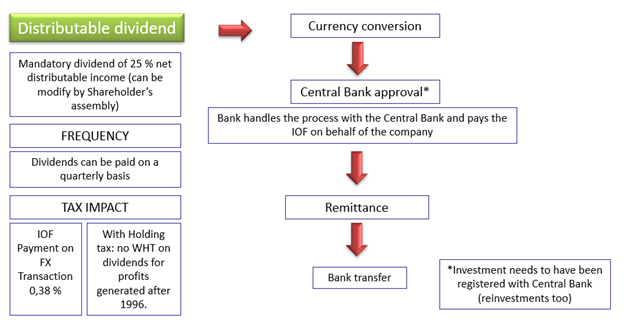

In compliance with Brazilian Corporate Law, the bylaws of Brazilian companies must stipulate a minimum percentage of available profits for the annual distribution of dividends, referred to as the mandatory dividend. This distribution must occur as either dividends or interest on shareholders’ equity, as established by Law No. 9,249/95. In alignment with its bylaws and Brazilian Corporate Law, a minimum of 25.0% of its adjusted net income must be allocated for the distribution and payment of the mandatory dividend to shareholders.

Furthermore, the payment of mandatory dividends may be restricted to the realized net income each year, with any surplus recorded as an unrealized profit reserve. Calculations of net income, allocations to reserves, and available amounts for distribution are based on annual financial statements prepared per Brazilian Corporate Law.

Approval of the yearly dividend declaration is contingent upon the shareholders’ meeting and hinges on various factors, including operating results, financial condition, cash requirements, prospects, and other considerations deemed relevant by shareholders and the Board of Directors. Although Brazilian Corporate Law mandates the annual payment of mandatory dividends, the company retains the right to suspend such distribution if its board of directors deems it inadvisable based on the company’s financial condition.

Any suspension would be subject to review by the fiscal council, if in place at the time, and the management would be obligated to submit a report to the CVM, detailing the reasons for the suspension. Net income not distributed due to a suspension would be allocated to a separate reserve and, if not absorbed by subsequent losses, would be required to be distributed as dividends as soon as the company’s financial condition permits.

According to Brazilian Corporate Law, participants at a shareholders’ meeting of a publicly traded company may decide, with no opposition from any present shareholder, to pay dividends in an amount less than the mandatory dividend. Alternatively, they may choose to withhold the entire net income, solely to raise funds through maturing and non-convertible debentures.

No, there is no income tax on dividends!

Contrary to most countries in the world Brazil dividends are not subject to income tax.

Foreign remittance

Once the company has determined the amount of dividends it wants to pay it will request the bank to proceed to the transfer offshore. Once the bank obtains approval from the Central Bank it will initiate the transfer. The bank will pay on the company’s behalf the IOF of 0,38% on foreign exchange transactions (up until 2029 this IOF remains payable).

Please note that the mother company should also assess how those dividends will be taxed when received. A thorough full check of double tax treaties if any is highly recommended.