But what is IOF?

The IOF, or Imposto sobre Operações Financeiras (Tax on Financial Operations), is a federal tax in Brazil established in 1964 by the Brazilian government. It has national applicability and serves as a means to collect taxes associated with financial operations conducted by both individuals and companies. In essence, the IOF is a comprehensive federal tax framework that encompasses credit, foreign exchange, insurance, and securities transactions.

Specifically, the calculation of IOF varies according to the nature of the financial transaction being executed. It is a dynamic tax, computed on a daily basis, considering the total amount involved in the transaction. The applicable rate differs depending on the specific type of financial activity undertaken.

What sets the IOF apart is its adaptability; the government retains the authority to adjust the IOF rates as needed. This unique characteristic makes it one of the exceptional taxes in Brazil that can be modified without requiring approval from the National Congress. The flexibility in adjusting the IOF rates allows the government to respond promptly to economic conditions and financial considerations.

The scope of the IOF extends to both physical individuals and legal entities. However, this article will focus exclusively on elucidating the impacts of IOF on legal entities, shedding light on the implications and considerations relevant to businesses engaging in various financial transactions in Brazil.

Different rates depending on the type of transaction

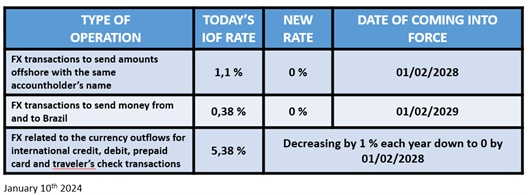

Maybe it is important to mention first that there has been an important modification to the IOF in 2022. In fact, by Decree No. 10,997/2022 the government has not only reduced and eased the payment of IOF but has also published a calendar that step by step organises the end of the IOF for 2029. At the same time still bear in mind that the IOF rates are variable and depend on the specific type of transaction conducted. These rates are set by the Brazilian government and are subject to change at its discretion.

But first, let’s look at the transactions subject to IOF.

As briefly mentioned above IOF applies to activities such as credit operations, currency exchanges, insurance transactions, and dealings with securities. It serves as a mechanism through which the Brazilian government gathers taxes from both individuals and businesses engaged in such financial activities.

1. Credit and investments

a. Credit

- Onshore loans

- For a pre-determined principal amount, the borrower incurs an annual maximum rate of 1.88% (comprising 0.38% upon issuance and a daily rate of 0.0041% on the principal, capped at 1.5%, resulting in a total of 1.88%). If the principal amount isn’t predetermined at the time of the loan’s initiation, a 0.38% IOF fee is applied immediately. A 0.0041% fee is levied monthly on the month-end outstanding balance, including accrued interests. This applies to overdrafts or working capital loans as well as long-term loans.

- The IOF also applies to loans between companies (Mutuos).

- Offshore loans

- Incoming loans to Brazil: Since March 2022 there have been no IOF on offshore loans of less (used to be 6% upfront for loans of less than 180 days before that). That has made short-term offshore intercompany loans more attractive for corporates.

- Outgoing loans from Brazil: subject to IOF in the same way as onshore loans (this is to remain up until 2029)

- Please note that for any of those above-mentioned cross-border transactions IOF on Foreign Exchange transactions remains due.

b. Investments

Investment-related taxation is unique to each type of investment, emphasizing the importance of considering IOF implications when assessing potential returns on your invested capital. Investment duration here is key with a big difference for placements up to 30 days and longer. Let’s review the most common placement options:

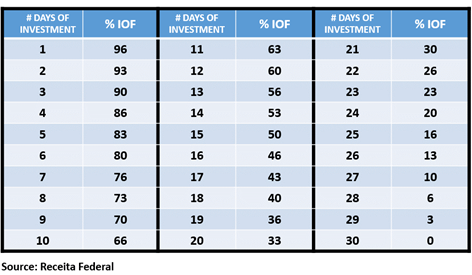

- Fixed Income: This category offers stability and predictable returns. However, investments like Bank Deposit Certificates (CDB), Bills of Exchange (LC), and Financial Bills (LF) are subject to IOF. The IOF rate depends on the investment duration, following a regressive table that resets after thirty days.

- Investment funds: Typically managed by financial institutions such as banks and brokers, investment funds also subject to the regressive IOF table. Notably, these funds become IOF-exempt if redeemed after a 30-day holding period.

- Shares: Unlike other investments, shares are not subject to IOF. However, it’s essential to account for additional expenses like custody and brokerage fees.

Calculating the IOF on less than 30 days investments

The tax authorities use the following regressive table to calculate the payable IOF

What are the placements free of IOF ?

- Any investment of more than 30 days

- LCI (Letra de Crédito Imobiliário) and LCA (Letra de Crédito do Agronegócio) which are certificates of deposit issued by banks to finance real estate or agriculture sectors. They are less liquid than regular CDs. Those instruments are also exempt from revenue tax.

- (CRA) Certificados de Recebíveis do Agronegócio and (CRI) Certificados de Recebíveis Imobiliários are certificates of deposits similar lo LCI and LCA but are issued by Securitization institutions.

2. Foreign exchange

All are subject to IOF payment of 0,38% . However in 2022 the government approved an agenda to definitely cancel IOF on Foreign exchange transactions (see table below)

Calendar of the Decree No. 10,997/2022 for FX transactions

3. Insurance

Life insurance is taxed by the IOF at a rate of 0,38% per transaction. For health insurance, the rate is 2,38 per cent and for property insurance, 7,38 per cent.

4.Financial instruments such as forwards, derivatives, swaps, and options

All are subject to IOF payment of 0,38%

How is IOF paid and when?

The IOF tax is automatically withheld by the bank, credit card company, or relevant institution handling the transaction, so you don’t have to do anything. Sometimes, you might receive a separate bill to settle this amount later. Although less frequent, credit card users might see IOF tax charges on their monthly statements.

In the case of loans between companies or between a company and an individual, the lender is responsible for paying the IOF on behalf of the recipient. To fulfil this obligation, the lender provides a payment document known as DARF to the Receita Federal (Brazilian tax authority).

When the IOF tax isn’t deducted upfront, understanding the payment deadline is essential. The month is divided into three distinct periods for this purpose:

- Days 1 through 10: First ten-day period of the month

- Days 11 through 20: Second ten-day period of the month

- Days 21 through the end of the month: Third ten-day period of the month

The payment deadline falls on the third business day of each ten days following the transaction. Non-respect of those deadlines will incur penalty charges.

Some transactions free from IOF

- Shares brokerage

- Some specific loan programs granted by BNDES such as FGI PEAC

- Remittances of interest on net equity (JCP) and dividends relating to foreign investment.

- Payment or reimbursement of registered capital (Capital Social)

- Foreign exchange operations related to revenues deriving from the export of goods and services from Brazil.

- Dividend payment abroad

- Buying a property for your use

- Credito Rural loans, a type of financing reserved for farmers

Strategy to pay less IOF, here’s how

While corporations cannot escape IOF payments, there is an opportunity for optimization after conducting a thorough assessment to calculate the total IOF expenditure. Break down the IOF spending by area and analyze how it can be optimized.

Optimize exchange rates and quantify IOF costs when purchasing foreign currency. For instance, when your staff travels abroad and needs to buy foreign currency, steer clear of credit cards with the highest IOF rate (5.38%) on the transaction value. Opt for cash, which carries a 1.1% rate, the lowest in this form of exchange. The same principle applies to buying plane tickets; avoid purchasing them outside Brazil.

An alternative for lower IOF on foreign currency purchases is to conduct an international transfer to an overseas account, with a 1.1% rate on the transfer value. This option helps bypass fees and margins charged by banks and traditional exchange operators.

Avoid using overdrafts, which carry one of the highest IOF and interest rates in the market (0.38%). Adjust any short-term capital loans, as they are not only expensive due to high interest rates but also significant contributors to IOF. Compare credit operations and opt for those with shorter terms and lower interest rates.

Analyze and optimize your working capital needs, conducting a rigorous cash segmentation analysis to minimize operating cash requirements and maximize placements of 30 days or more, resulting in lower IOF on income. This analysis can also reveal areas of idle cash that can be put to more productive use.

Strategize your financial operations; if you anticipate multiple IOF-incurred transactions, try to consolidate them into a single operation, as IOF is typically charged for each separate transaction.

Choose IOF-free financial transactions whenever possible; certain transactions, such as purchasing property for personal use, are exempt from IOF.

Opt for cash purchases over instalment payments, as IOF is applied to the outstanding balance. By making cash purchases, you avoid accumulating this tax.

Don’t overlook a comprehensive analysis of all insurance contracts to ensure they are well-calibrated to your needs. IOF payments on insurance are among the highest.

In summary, minimizing the impact of IOF aligns with sound management practices. Therefore, before engaging in any financial transaction, whether it’s a loan, an international purchase, or an investment, it is crucial to consider the implications of IOF and how it may affect the final cost of the operation.